Four main factors are related to Indonesia's economic growth in 2021

- Details

- Written by Kirana

- Category: News

- Hits: 2038

The Faculty of Economics and Business (FEB) UGM together with PP KAFEGAMA, KAFEGAMA DIY, ISEI Yogyakarta, Bank of Indonesia, the Ministry of Finance of the Republic of Indonesia, the Directorate General of Taxes of the Indonesian Ministry of Finance, and the Indonesian Chamber of Commerce and Industry (KADIN) held a seminar with the topic "Indonesian Acceleration Progress through Investment and Fiscal Incentives (Perpres 10/2021 and PMK 18/2021)" on Thursday (01/04). This seminar was held online through the Zoom Webinar application and broadcasted live on the Fakultas Ekonomika dan Bisnis UGM Youtube channel and was witnessed by thousands of viewers.

This seminar was opened by Ridha Basuki as the Master of Ceremony (MC) in charge. Before entering the core of the seminar, Eko Suwardi, M.Sc., Ph.D., Dean of FEB UGM, gave a warm welcome to start the webinar followed by remarks from the UGM Rector, Prof. Ir. Panut Mulyono, M.Eng., D.Eng., IPU, ASEAN Eng. Furthermore, Perry Warjiyo, Ph.D., as the Governor of Bank of Indonesia and Chairman of PP KAFEGAMA also gave a warm welcome which was followed by a keynote speech by the Minister of Finance of the Republic of Indonesia, Sri Mulyani Indrawati, who started the topic discussion of this seminar.

The event continued to enter the core of the event guided by Amirullah Setya Hardi, Vice Dean III of FEB UGM, as the moderator of the event. There were 3 speakers in this seminar discussion representing 3 perspectives to discuss seminar topics. The first speaker, from the tax regulators, was Hestu Yoga Saksama as Director of Tax Regulations I at the Directorate General of Taxes, Ministry of Finance of the Republic of Indonesia. According to Hestu, in terms of taxation, the Job Creation Law (UU Cipta Kerja) provides a few themes in supporting companies in Indonesia. He further explained the themes which consist of increasing investment funding, encouraging taxpayer compliance, increasing legal certainty, and creating a fair climate for business and also explained each substance.

In addition to this, Hestu also reviewed the implementing regulations for the Job Creation Law in the field of income tax and also discussed the criteria, specific timeframes for investment, and procedures for tax exemptions. Regarding Presidential Decree No. 10 2021 concerning the investment business sector focusing on tax incentives, Hestu mentioned tax incentive policies to encourage economic strengthening which include tax holidays, mini tax holidays, tax allowances, special economic zones, vocational super deduction, super deduction research and development, and investment allowances. Not to forget, he also explained several examples of the realization of the tax incentive policies.

The event continued by presenting the second speaker from tax consultants, Darussalam who is a tax consultant from the Danny Darussalam Tax Center. Darussalam provided a material presentation titled as "Income Tax Aspects in the Job Creation Law and Its Derivative Regulations for Fiscal Incentives". The material he discussed includes the tax regime for foreigners with certain skills, exemptions from domestic dividends, exemptions from dividends and foreign income, exemptions from BPKH income, and exemptions from the residual of social and/or religious institutions. At the end of the session Darussalam emphasized to taxpayers, "Use the incentives that have been given in the Job Creation Law as much as possible as a way for us to build and accelerate towards an advanced Indonesia through the participation of taxpayers."

After discussing the topic from the perspective of regulators and consultants, then the third speaker in this discussion session, Rosan Perkasa Roeslani as the General Chairman of the Indonesian Chamber of Commerce and Industry, discussed the topic of the seminar from the perspective of entrepreneurs related to economic development in the business world. Rosan expressed his hope that the Job Creation Law and its derivatives would not only increase the flow of investment into Indonesia, but also improve the effectiveness and investment climate in Indonesia. In addition, he hoped that there will be a removal of regulations that hinder the investment process and make doing business easier. According to him, investment allocation needs to be directed to be more focused on productive and export-oriented sectors to encourage economic growth.

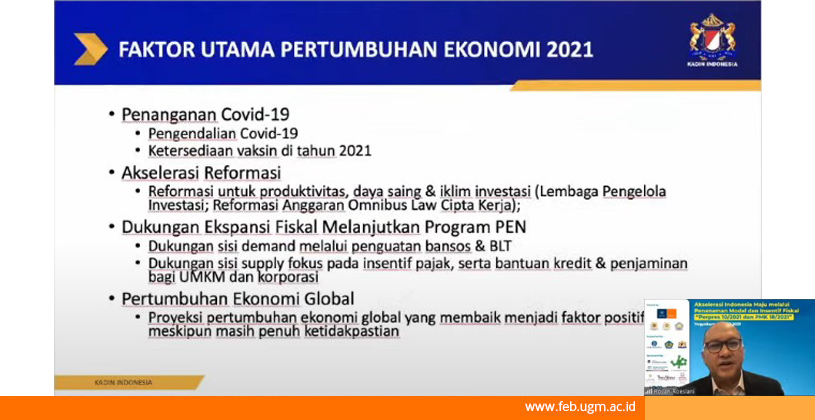

Not only that, Rosan also discussed structural reforms for Advanced Indonesia through two aspects, which are enabling the environment by providing the necessary infrastructure for the development of new industrial sectors and productivity improvement, for example by revitalizing manufacturing or developing tourism. Regarding economic growth in 2021, there are four main factors according to Rosan in his discussion, namely the handling of Covid-19, accelerated reforms, support for fiscal expansion continuing the PEN program, and global economic growth. The seminar ended with a question and answer session addressed to all speakers.

Reportage: Kirana Lalita Pristy/Sony Budiarso.

Video: https://youtu.be/KnTSl2Cdp1U