Opportunities and Challenges of Islamic Accounting Development

- Details

- Written by Leila

- Category: News

- Hits: 1587

In commemoration of the 65th Anniversary (Lustrum XIII), the Faculty of Economics and Business UGM, the Master of Accounting Study Program FEB UGM, collaborated with the Indonesian Chartered Accountants (IAI) Chapter DI Yogyakarta to hold a seminar entitled "Development Opportunities and Challenges Sharia Accounting” last Thursday(3/9). The event presented Prof. Dr. Bambang Sudibyo, MBA. (Chairman of the National Zakat Agency/BAZNAS and Professor of FEB UGM), Deden Firman Hendarsyah, M.Buss. (Director of Sharia Banking Regulation and Licensing at the Financial Services Authority / OJK), Drs. Fahmi Subandi, Akt., M.Agr. (Operational Director of BRI Syariah), Prof. Mahfud Sholihin, Ph.D. (Chairman of the Sharia Accounting Standards Board / DSAS at the Indonesian Institute of Accountants / IAI and Professor of FEB UGM), and Sutrisno Mukayan, MM., Akt. (Head of BRI Syariah Accounting and Finance Division) as the resource person. The event was moderated by Aprilia Beta Suandi, M.Ec., Ph.D. (Lecturer at the Department of Accounting, FEB UGM).

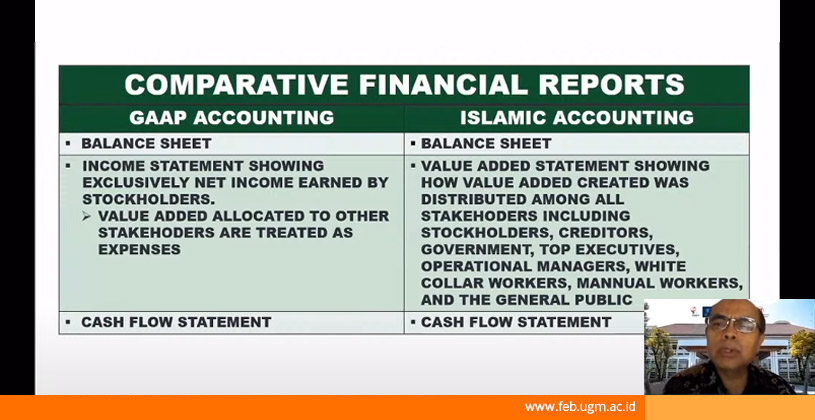

Prof. Mahfud said that in Islamic accounting there is a combination of two elements of science, namely accounting, and sharia. The approach used, namely the ideal approach (exploring authoritative sharia sources and then derivative) of the sky approach and the pragmatic approach that uses conventional accounting to then carry out the purification process. The two approaches can be carried out in parallel. In this approach, of course, it must be based on the maqashid sharia principles.

Indonesia has quite high ambitions regarding the sharia economy, namely to become one of the world's sharia economic centers. To achieve this target, the government formed the National Committee for Sharia Economics and Finance (KNKES) chaired by President Joko Widodo. Bambang said that the milestones until the ecosystem design had been formed, but the development of Islamic accounting still faced many challenges. The biggest challenge is how to break away from the paradigm and way of thinking of conventional capitalistic financial accounting and then develop its Islamic paradigm.

In the sharia banking industry, total sharia financial assets have increased from 2019. As of June 2020, Indonesia's total Islamic financial assets reached Rp1,608.50 trillion or USD 112.47 billion. This shows the significant growth potential of Islamic finance in Indonesia. However, the development of Islamic accounting is still reaping several problems. Therefore, Deden said that a synergy of the Islamic economic ecosystem is needed through strengthening the identity of Islamic banking.

Fahmi also investigated the development of Islamic banking which is increasing. This development was followed by increasing government support for the Islamic economy. This brings new opportunities in the form of business process and industrial transformation so that sharia registration can grow. However, this is at the same time a challenge so that accountants must be equipped with deeper knowledge related to technology and analytical data. In the last session, Sutrisno highlighted the challenges of implementing sharia accounting, such as PSAK 102, PSAK 111, and PSAK 107. But in truth, the real challenge in sharia accounting is related to public acceptance of the Islamic economic concept.

Translator: Laras OIA