Indonesia’s Triple Challenges in the Global Economic Turmoil and the Use of New Consensus in Macroeconomic Analysis

- Details

- Written by FEB UGM

- Category: News

- Hits: 2616

Facing the Triple Challenges stated by the Ministry of Finance of the Republic of Indonesia (Kemenkeu), Thursday (16/6), the Laboratory of Economics, Faculty of Economics and Business Universitas Gadjah Mada (FEB UGM) collaborating with the Macroeconomic Dashboard held a Seminar and Public Lecture (SinarKU) entitled “Triple Challenges, Unsustainable Low Interest Rates and Recession: A New Consensus in Macroeconomic Analysis”. SinarKU this time was held online via Zoom Meeting. SinarKU moderated by Shima Dewi Mutiara Trisna, S.E., M.Sc. and presenting speakers, namely Prof. Dr. Insukindro, M.A., a lecturer at the Department of Economics, FEB UGM.

Insukindro opened the seminar by reviewing global economic issues, namely the sharp increase in commodity prices due to the Russia vs Ukraine war, the lockdown in China, disruption of world supply chains, and the effects of the continuation of Covid-19. Due to the increase in commodity prices, the price of raw materials at the industrial level also rose and caused high inflation in developed countries, including the United States at 8.5% and the UK at 9%. Responding to this, in a press conference on May 23, 2022, the Minister of Finance of the Republic of Indonesia, Sri Mulyani, stated that there were Triple Challenges, namely high inflation, high interest rates, and weak economic growth. Insukindro explained that, econometrically through cointegration testing, this indicates an unsustainable low interest rate. Triple Challenges also mentions the phenomenon of shrinkflation, which is defined as an inflation caused by downsizing packages where companies shrink products and sell at the same price. Insukindro gave an example of shrinkflation with the case of bakpia (round-shaped Indonesian sweet roll), which is now smaller than it was a few years ago, but at the same price. It should also be underlined that shrinkflation is not recorded in the calculation of inflation by BPS using the BPS block sample method.

Reviewing the World Bank's report, world economic growth, for example in Europe and America, is experiencing a decline, while Indonesia is not experiencing a recession. This is because in year over year (y-o-y) calculations, Indonesia shows an economic growth of 5.1%. However, Insukindro refers to the opinion of Paul Donovan, a financial consultant and author of the book “The Truth about Inflation” (2022), which stated that inflation calculated by the consumer price index (CPI) tends to be biased towards high-income groups. In addition, Donovan proposed that inflation should not only be calculated by the consumer price index but also the producer price index, or in the accounting world refers to the valuation of business assets. Meanwhile, in calculating the recession, Julius Shiskin stated the rule of thumb that if a country in two consecutive quarters experiences an economic downturn, then the country is in recession. However, as will be discussed further, according to Insukindro's calculations and referring to Glenn Hubbard, in the first quarter of 2022, Indonesia experienced a recession.

Insukindro presented the results of the Press Conference on the Decision of the Meeting with Bank Indonesia (BI) chaired by Perry Warjiyo, SE, MSc, Ph.D as Governor of BI. In this discussion, there were several decisions that Insukindro considered interesting, including that BI maintained the BI 7-Day Reverse Repo Rate (BI7DRR) at 3.5%, the Deposit Facility interest rate at 2.75% and the Landing Facility interest rate at 4.25. % which aims to maintain exchange rate stability and control inflation. Based on the press conference, Insukindro estimated economic fluctuations using the concept of the Hubbard equation, namely fet = {Yt-E(Yt)}/E(Yt) with fe=economic fluctuations and E(Y) = estimated output. Referring to the equation, if fe<0 then the country is in recession, otherwise if fe>0, the country is experiencing expansion. Meanwhile, in calculating economic growth, Hubbard formulates get = (Yt-Yt-1 )/Yt-1 . Referring to the equation, if ge<0 and sustainable, the country is experiencing an economic decline (slump).

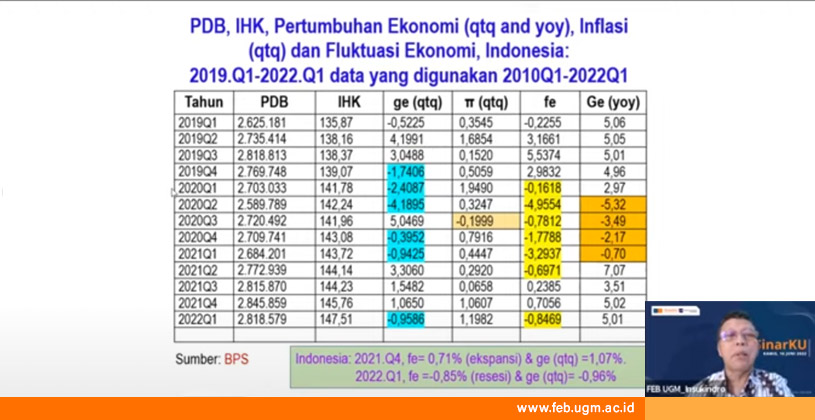

Insukindro presents a table of BPS data for the first quarter of 2019 to the first quarter of 2022 regarding Gross Domestic Product (GDP), quarter to quarter (q-t-q) and y-o-y economic growth, and CPI and compares BPS calculations with their calculations according to the Hubbard equation. The data shows that according to the y-o-y calculation, Indonesia experienced a recession in the 3rd quarter of 2020, because economic growth showed a negative value for two consecutive quarters. However, based on Insukindro's calculations, Indonesia has experienced a recession since the 1st quarter of 2020. Furthermore, in the 1st quarter of 2022, Insukindro stated that Indonesia was in a recession, because economic growth was at -0.9586%, contrary to the World Bank's calculation of 5. 01%. Therefore, circumfection is needed on World Bank statements regarding Indonesia's economic growth, he asserted.

Insukindro continued with an explanation of the new school of economics. Historically, the classical school of thought derived the Keynesian school of thought, then the Keynesian school of thought derived the Keynesian school of thought. The classical school then converged with the Keynesian school of thought into the Neoclassical Synthesis, with Paul Samuelson as the Godfather of the Neoclassical school. Classical flow also derived new classics, new classics derived business cycle theory. On the other hand, Keynesians derive New Keynesians. The two converged into the New Neoclassical Synthesis, also known as the New Keynesian Synthesis or New Consensus Macroeconomics. Insukindro, referring to Geese & Wagner (2007) uses one of the neoclassical synthesis models to calculate the goods market balance and the inflation adjustment curve. Insukindro modifies the IS and MP curves by shifting the R axis to the right, so that on the right Y=YP is positive, and vice versa. Referring to Hubbard, if the point is positive then the country is expanding, otherwise if the point is negative then the country is in recession.

Furthermore, based on the Keynesian Cross, Insukindro continues to create analysis with a new style of aggregate supply curve. Insukindro conducts MGW-PT analysis with Geese & Wagner analysis on an open economy. Using the new consensus macroeconomic analysis, it is concluded that in the fourth quarter of 2021, Indonesia will experience expansion, with economic fluctuations of 0.71%. However, in the first quarter of 2022, Indonesia experienced a recession, with economic fluctuations of -0.85%. Therefore, a monetary stimulus is needed, namely by raising or lowering interest rates by Bank Indonesia. Fiscal stimulus can also be done because fiscal stimulus will shift the IS curve up and aggregate demand to the right. At the end of the event, Shima Dewi elaborated a takeaway in SinarKU that in the midst of the global economic turmoil, Indonesia's economic condition which is facing the Triple Challenges, and according to Prof. Insukindro is experiencing a recession, she hopes that the audience, which is partly business people and academics, can formulate strategies so that they don't fall into and be impacted by recessions.

Reportage: Hayfaza Nayottama