Business Digitalization and the Role of Fintech in the Post-Covid Era

- Details

- Written by Kirana

- Category: News

- Hits: 1102

Today, facing the transition era towards post-Covid-19, businesses need to adapt by implementing digitalization. The topic related to this, titled as “Business Digitalization Post-Covid Era: The Role of Fintech” was discussed in a series of lectures as part of the virtual summer program held by the Faculty of Economics and Business, Universitas Gadjah Mada (FEB UGM) on Wednesday (29/06), namely International Week (iWeek) 2022. On the day of the event, the lecture series presented an expert speaker on the topic, namely Hendri Saparini, Ph.D., as the Steering Committee of the Indonesian Fintech Society (IFSoc).

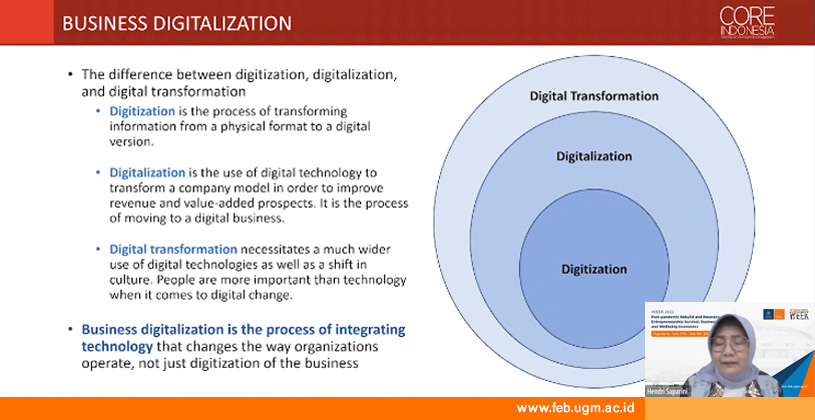

More specifically, in her presentation Hendri talked about Fintech from a microeconomic point of view. At the beginning of the presentation, Hendri mentioned that the Covid-19 pandemic had a significant impact on the acceleration of digitalization and transformation of work. Regarding the economic recovery, according to her, the recovery from the pandemic-covid economic crisis is different from other economic crises. She also explained what is meant by business digitalization, which is the process of integrating technology that changes the way organizations operate, not just digitization of the business. "With the digitization of businesses, including large companies and SMEs, we hope that everyone will have the same opportunity to market their products with big players," she said.

Next, entering the topic of Fintech, Hendri mentioned that Fintech is one of the fastest growing business digitalizations after the pandemic-covid outbreak. However, Fintech is a highly regulated sector and its ecosystem is very important. Fintech developments have different characteristics and speed in each country depending on the availability of hard and soft infrastructure (policy & regulation). Hendri also added that to reduce risk and accelerate Fintech development, several things can be done such as increasing financial literacy, enforcing consumer data protection, strengthening cyber security, enacting supportive regulations, and developing human resources.

At the end of the discussion, Hendri stated a number of reasons why during this economic recovery period there will be no reduction in the level of digitalization in the business field. Based on the latest data, nationally in 2022, as many as 86% of consumers and MSMEs are highly dependent on the existence of the internet to carry out various economic activities. One of the reasons for this dependence is because the use of internet-based digital services makes daily activities much easier. In addition, the government has made efforts to increase cashless transactions through various payment system innovations. Since 2017, a number of e-moneys and e-wallets have been growing to facilitate online payments. The lecture series ended with a discussion of several questions related to the topic with the iWeek 2022 participant groups.

Reportage: Kirana Lalita Pristy

Video: https://youtu.be/RTk14kWuwsA